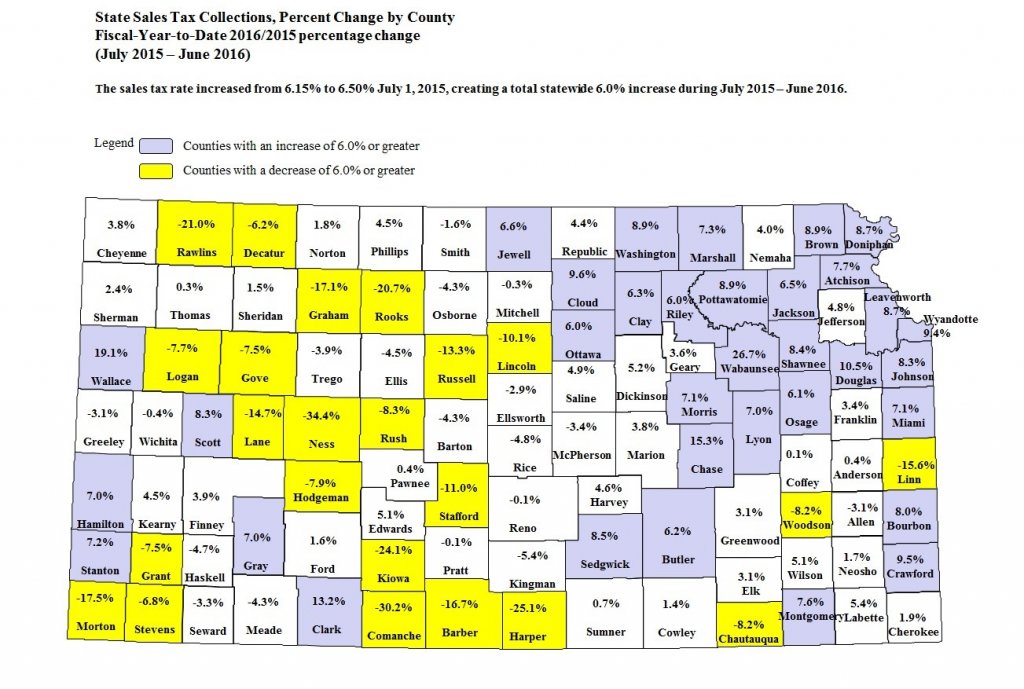

sales tax wichita ks 2016

However part of the city lies in Shelby County and is subject to a total rate of 9 percent. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Owning Gold And Precious Metals Doesn T Have To Be Taxing

Average Sales Tax With Local.

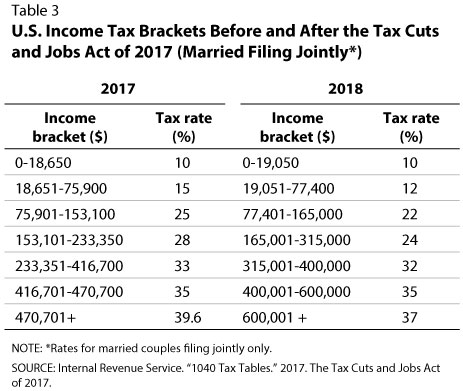

. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. The average cumulative sales tax rate between all of them is 85. 120 rows Table 1.

The Sedgwick County Sales Tax is collected by the merchant on all qualifying sales made within Sedgwick County. The average cumulative sales tax rate in Wichita Kansas is 75. The Wichita County sales tax rate is.

The December 2020 total local sales tax rate was also 8500. The 2018 United States Supreme Court decision in South Dakota v. Within Wichita there are around 32 zip codes with the most populous zip code being 67212.

State and Local Sales Tax Rates in Cities with Populations above 200000 as of July 1 2016. Finance Apply Online Get Pre-Approved Edmunds Trade-In. Avalara provides supported pre-built integration.

Finance Apply Online Get Pre-Approved Edmunds Trade-In. Elite Auto Sales - Wichita KS. The sales tax rate does not vary based on location.

Inventory All Inventory Edmunds Trade-In. The minimum combined 2022 sales tax rate for Wichita Kansas is. This includes the sales tax rates on the state county city and special levels.

Wichita is located within Sedgwick County Kansas. Tax Rate Wichita Douglas Market Development CID. This is the total of state county and city sales tax rates.

State of Kansas and the county seat of Sedgwick County. What is the sales tax rate in Wichita Kansas. There are a total of 531 local tax jurisdictions across the state collecting an average local tax of 1979.

Reviews Our Store. Elite Auto Sales - Wichita KS. You can print a 75 sales tax table here.

The local rate s are added to the state rate to arrive at the total sales tax percentage collected by a retailer or contractor. For tax rates in other cities see Kansas sales taxes by city and county. In addition to the state sales tax Kansas counties incorporated cities and special taxing districts may impose a local sales tax.

Are groceries taxed in Kansas. This rate is the sum of the state county and city tax rates outlined below. 205 E Douglas Avenue 221 223 E Douglas Avenue odd addresses.

Sedgwick County collects a 1 local sales tax the maximum local. This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Wichita County Kansas is.

Net Trade-In Down Payment Estimated Credit Score Estimated. Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4. The most populous zip code in Wichita County Kansas is 67861.

The most populous location in Wichita County Kansas is Leoti. The sales tax rate does not vary based on zip code. Effective July 1 2022 CITY CHANGES Jurisdiction Code.

Wichita County collects a 2 local sales tax the maximum local sales tax. The Wichita County Sales Tax is collected by the merchant on all qualifying sales made within Wichita County. Wichitans are projected to pay about 75 percent of the countywide 1-cent-on-the-dollar sales tax in 2016.

Wichita County KS Sales Tax Rate. Excluding taxes and fees 34500. DeSoto Johnson County DESJO.

This notice addresses changes to the Kansas sales and use tax rates. The current total local sales tax rate in Wichita County KS is 8500. B Most of New Orleans is located within Orleans.

Elite Auto Sales - 2016 Cadillac SRX Luxury Collection - Used Cars and Trucks Near Wichita. The Wichita sales tax rate is. Sales tax wichita ks 2016 Sunday June 12 2022 Edit.

But the city is projected to get only 58 percent of. The Kansas state sales tax rate is currently. The 75 sales tax rate in Wichita consists of 65 Kansas state sales tax and 1 Sedgwick County sales tax.

As of the 2020 census the population of the city was 397532. The County sales tax rate is. The Wichita County Kansas sales tax is 850 consisting of 650 Kansas state sales tax and 200 Wichita County local sales taxesThe local sales tax consists of a 200 county sales tax.

Inventory All Inventory Edmunds Trade-In. There is no applicable city tax or special tax. Sales Tax Breakdown For Wichita County Kansas.

Elite Auto Sales - 2016 Toyota 4Runner Limited - Used Cars and Trucks Near Wichita. The Sedgwick County Kansas sales tax is 750 consisting of 650 Kansas state sales tax and 100 Sedgwick County local sales taxesThe local sales tax consists of a 100 county sales tax. Has impacted many state nexus laws and sales tax.

Shop Camping World RV sales today. Topeka KS tpk wichita KS wic show 23 more. Sales tax wichita ks 2016 Friday June 24 2022 Edit Wichita County in Kansas has a tax rate of 85 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Wichita County totaling 2.

There are also local taxes up to 1 which will vary depending on region. Net Trade-In Down Payment. Excluding taxes and fees 19500.

A Most of Birmingham is located within Jefferson County and is subject to a 10 percent sales tax. Kansas views on tax shortfall hopes for 2016 food sales tax Medicaid expansion The Wichita Eagle. Each band member 4 makes 2750 before tax.

The Kansas statewide sales and use tax rate is 65. The sales tax rate does not vary based on zip code. The Kansas sales tax rate is currently.

Calculate Auto Registration Fees And Property Taxes Geary County Ks

On Corporate Income Taxes Employment And Wages St Louis Fed

Does Past Development Projects Color The Future Of Wichita The Wichita Eagle

/cloudfront-us-east-1.images.arcpublishing.com/gray/2YXRYZQZPND75FXD5B677KCNBM.jpg)

Homeowners Across Sedgwick County Likely To See Rise In Property Taxes

Card Games Super Sunday Arcade Games

/cloudfront-us-east-1.images.arcpublishing.com/gray/2YXRYZQZPND75FXD5B677KCNBM.jpg)

Homeowners Across Sedgwick County Likely To See Rise In Property Taxes

Which Counties Pay The Most Taxes In Kansas You Ve Probably Guessed Correctly Wichita Business Journal

Former Irs Employee Pleads Guilty To Tax Evasion Doj Says

Where S My Refund Kansas H R Block

No Johnson County Didn T Secretly Raise Your Property Taxes Kcur 89 3 Npr In Kansas City

Tax And Budget Archives Kansas Action For Children

Tax And Budget Archives Kansas Action For Children

/cloudfront-us-east-1.images.arcpublishing.com/gray/2YXRYZQZPND75FXD5B677KCNBM.jpg)

Homeowners Across Sedgwick County Likely To See Rise In Property Taxes

Tax Cuts And The Kansas Economy Kansas Policy Institute